As you approach age 65 and begin counting down the days to Medicare eligibility, you might be surprised to discover that there are four “parts” to Medicare, each covering different medical needs.

Further, it can also come as a shock to find out that Medicare doesn’t always cover 100% of your medical bills. This is especially true for Medicare Part B, the portion of Medicare that covers doctor’s visits, outpatient care, and diagnostic tests. In many instances, Medicare patients choose a Medicare Supplement Plan (also called Medigap).

This article will overview what Medicare Part B covers, whether a Medicare Supplement Plan is right for you, and when you can enroll for Medicare Part B coverage.

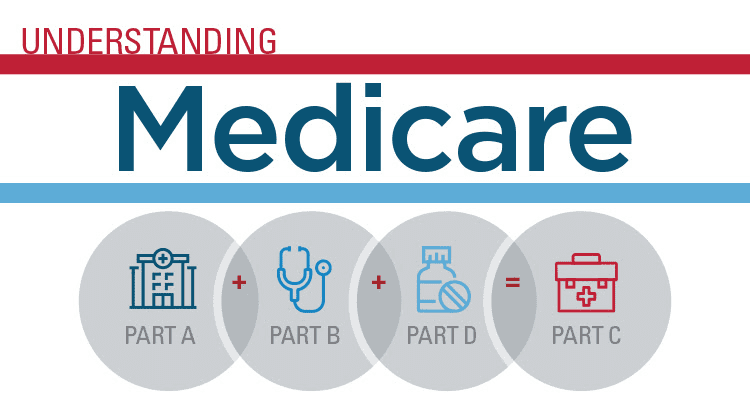

The Four Parts of Medicare

Before diving into Medicare Part B, it can be helpful to provide some context about the different parts of Medicare and what each generally covers.

Medicare Part A

With Medicare Part A, patients receive full coverage for inpatient hospital stays, hospice care, care received at a skilled nursing facility, and home health care (in limited situations).

Medicare Part B

In general, outpatient care and treatments fall under Medicare Part B. This includes visits to the doctor’s office, some prescription drugs administered by your doctor, diagnostic tests like lab tests and x-rays, home health services, chiropractic care, and durable medical equipment.

Medicare Part C

Referred to as Medicare Advantage, Medicare Part C combines the benefits of Parts A and B. It’s a type of health insurance offered through private companies where patients pay a monthly premium for additional coverage.

Medicare Part D

Prescription drugs comprise the entirety of Medicare Part D. You can remember it because D is the first letter in drugs. Currently, there are 20 different ways to structure Medicare Part D coverage, so it’s essential to do research or speak with an experienced insurance agent to protect your pocketbook from surprise expenses that often accompany skyrocketing prescription drug costs.

Eligibility for Medicare Part B

To qualify for Medicare Part B, you must meet at least one of the three eligibility requirements:

- Be 65 years of age or older and have been a lawful U.S. resident for at least five consecutive years

- Have a qualified disability

- Have ESRD (end-stage renal disease) or ALS (amyotrophic lateral sclerosis)

What Does Medicare Part B Cover?

Of the Medicare alphabet soup, Medicare Part B covers the broadest range of services. There are also specific enrollment windows that you must adhere to prevent facing financial penalties.

Medicare Part B encompasses the bulk of your medical coverage under Medicare, including:

- Doctor visits

- Outpatient care

- Urgent care

- Emergency room services

- Ambulance services

- Durable medical equipment

- Preventative Care

- Chiropractic adjustments

- Mental health services

- Non-self-administered medications

To summarize, Medicare Part B covers any “medically necessary service” from a provider in Medicare’s network.

Unlike Medicare Part A, Medicare Part B is not free. Though some patients are eligible for free, most Americans will have to pay a monthly premium to enroll in Medicare Part B coverage. The monthly premium varies each year and is also dependent on your income.

On top of the monthly premium, there are additional fees for your services. There is a standard annual deductible for Part B coverage (currently $233) that resets every January 1st. After the deductible is met, Medicare pays 80% of the cost of your treatments, leaving you with the bill for the remaining 20%.

Medicare Supplement Plans

It’s important to note that there is no cap on the 20% number. Therefore, in the event of a catastrophic accident, major surgery, or chemotherapy, you are still on the hook for the full 20% remainder of the bill, which could be a substantial fee.

Because there is no limit to how high your out-of-pocket expenses can climb, many people opt for a Medicare Supplement Plan to protect themselves from a surprise bill with multiple zeros.

Should You Enroll in Medicare Part B?

Enrollment in Medicare Part B is optional, but it is recommended for most Medicare-eligible patients, especially at the first point of eligibility.

There are exceptions, however, if you are still working in your career and have other employer-provided health insurance. In this situation, delaying enrolling may be in your best interest. You can do so without penalty as long as your employer has at least 20 employees.

It’s recommended to enroll during the initial enrollment period (IEP for short) if you are:

- Retired

- Self-employed

- Without health coverage from your employer

The IEP Period

The initial enrollment period is a window that starts three months before the month you turn 65 and extends to up to three months after the month of your 65th birthday. Depending on where your birthday falls in the month, the enrollment period could span seven months.

If you are interested in being covered under Medicare Part B as soon as possible, it’s advisable to begin enrollment prior to your birth month to avoid any delays. Enrolling during or after your birth month could delay coverage for up to three months.

This delay can potentially be prevented if you were employed during the three-month period prior to your birthday month. There is a Medicare Part B Special Enrollment Period that allows you to enroll up to eight months after leaving employment without incurring delays.

The General Enrollment Period

In addition to the initial enrollment period, there is also a general enrollment period for anyone who “forgot” to enroll in Medicare Part B. This period is active between January 1st and March 1st of each year. If you enroll during this period, your coverage will be due to begin on July 1st

Get Started with a Free Medicare Insurance Quote

As you can see, there is a lot to keep track of with Medicare coverage, including the various parts. The focus of this article was on Medicare Part B, but you can read about Medicare Part D here. For a free Medicare insurance quote, contact us online or call toll-free at (800) 219-0453.