What is a Medicare Supplement?

Guide to Understanding Medicare Supplement

When you have Medicare, it helps pay for a lot of your healthcare costs, like

doctor visits, hospital stays, and other services.

What is Medicare Supplement Insurance?

Medicare Supplement coverage (Medigap) covers 10 million Medicare beneficiaries. Also referred to as Medigap plans, these policies help pay for your share of Medicare expenses, such as deductibles and co-insurance. Medicare supplement

insurance plans are available for purchase in all 50 states and are very popular with people who want little to no copays when they access healthcare services.

Many people new to Medicare feel surprised to find that Medicare covers only 80% of your Part B expenses. The other 20% can financially devastate you if a serious illness arises. You can choose a Medicare Supplement insurance that will pay some or all of that 20%, among other things. Supplemental insurance for seniors with Medicare essentially buys you peace of mind by eliminating that cost-sharing responsibility.

Medicare Part B only covers 80% of your medical expenses. Medicare Supplement (Medigap) plans help pick up the excess costs.

Also, during your one-time open enrollment window, you are guaranteed the right to purchase a Medicare Supplement plan. Your health status does not matter when you buy a plan during this six-month window.

What is Medicare Supplemental Insurance? Medicare supplements came into being shortly after Medicare was signed into law. Because you are required to pay for some things, like 20% of outpatient expenses, supplemental policies were created to pay those expenses for you. This makes people worry less about how much each medical visit will cost.

Some of the primary advantages of a traditional Medicare Supplement policy are:

- Freedom to choose your doctors and hospitals

- No referrals are required to see a specialist

- Predictable out-of-pocket expenses for Medicare-covered services (and zero out-of-pocket with Plan F)

- Nationwide coverage – you can use it anywhere in the United States

- Guaranteed renewability – the insurance company can never drop you or change your coverage due to a health condition

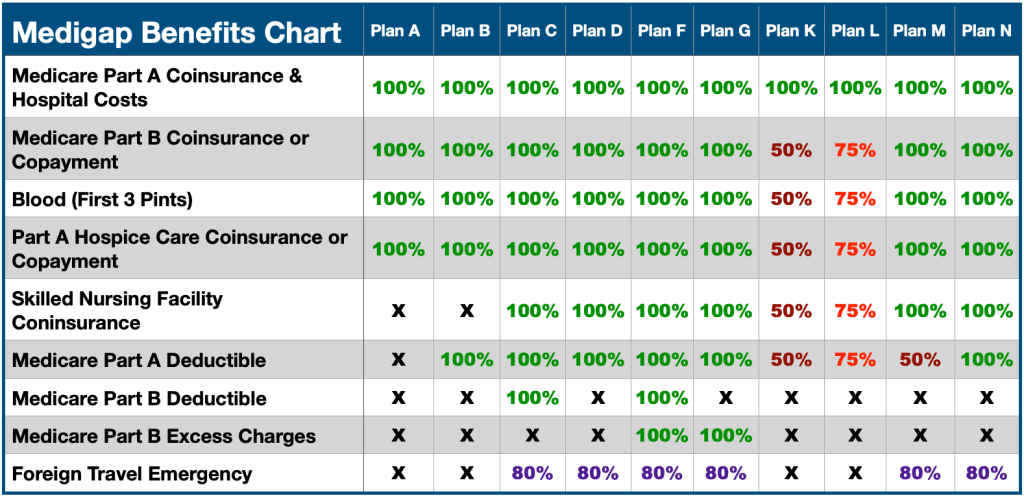

Medicare Supplements Plans – Standardized Plans to see a list of all the Medicare supplemental plans available – take a look at our Medigap supplement chart above. This chart appears in the “Choosing a Medigap,” booklet published by Medicare itself. It details the benefits covered by each different plan.

Some of our clients have found Medicare’s handbook hard to read, so here on our site, we’ve tried to use simpler terms. Our pages about the different Medicare Supplements include examples of how the coverage would pay. This will help you understand how they work in real situations.

*Medigap Plan F and Plan G is also offered as a high-deductible plan (HDF or HDG) by some insurance companies in some states. If you choose the high-deductible option, it means you must pay for Medicare-covered costs (coinsurance, copayments, deductibles) up to the deductible amount of $2,800 in 2024 before your policy will pay anything.

For Medigap Plans K and L, after you meet your annual out-of-pocket limit and your annual Part B deductible ($240 in 2024), the Medigap plan pays 100% of covered services for the rest of that calendar year.

Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don’t result in an inpatient admission. You can find this chart as well as other great info in Medicare’s Choosing a Medigap booklet as well, which you can find here.

What are the different Medicare Supplements Plans? Each Medicare Supplement plan in the chart above has a letter, A – N. Each plan letter provides a different set of benefits. However, each lettered plan must have the same standardized coverage regardless of which insurance company you choose. For example, Medicare Supplement Plan N at Blue Cross Blue Shield has the same benefits as Plan N from United Healthcare.

The Medicare Supplement chart below shows the 10 standardized Medicare Supplement plans. These plans can be offered by insurance companies in most states.

Wisconsin, Minnesota and Massachusetts have different options though.

There is one supplemental insurance plan that covers ALL OF the gaps, leaving you with nothing out of pocket, Plan F. There are others where you agree to do some cost-sharing and in return you get a lower monthly premium. If you prefer something like this, in the middle, you could look at Plans G or N where you pay a few things yourself, in exchange for lower premiums.

An insurance agent who specializes in Medicare supplemental insurance for seniors with Medicare can help you determine which one best suits you.

- Medicare Supplement coverage (Medigap) covers 10 million Medicare beneficiaries. Also referred to as Medigap plans, these policies help pay for your share of Medicare expenses, such as deductibles and co-insurance. Medicare supplement insurance plans are available for purchase in all 50 states and are very popular with people who want little to no copays when they access healthcare services.

- Many people new to Medicare feel surprised to find that Medicare covers only 80% of your Part B expenses. The other 20% can financially devastate you if a serious illness arises. You can choose a Medicare Supplement insurance that will pay some or all of that 20%, among other things. Supplemental insurance for seniors with Medicare essentially buys you peace of mind by eliminating that cost-sharing responsibility.

- Medicare Part B only covers 80% of your medical expenses. Medicare Supplement (Medigap) plans help pick up the excess costs. Also, during your one-time open enrollment window, you are guaranteed the right to purchase a Medicare Supplement plan. Your health status does not matter when you buy a plan during this six-month window.

- What is Medicare Supplemental Insurance? Medicare supplements came into being shortly after Medicare was signed into law. Because you are required to pay for some things, like 20% of outpatient expenses, supplemental policies were created to pay those expenses for you. This makes people worry less about how much each medical visit will cost. Some of the primary advantages of a traditional Medicare Supplement policy are:

- Freedom to choose your doctors and hospitals

- No referrals are required to see a specialist

- Predictable out-of-pocket expenses for Medicare-covered services (and zero out-of-pocket with Plan F)

- Nationwide coverage – you can use it anywhere in the United States

- Guaranteed renewability – the insurance company can never drop you or change your coverage due to a health condition

- Supplemental insurance for seniors with Medicare is the most predictable back-end coverage you can buy. You will know exactly what’s covered for every inpatient or outpatient procedure based on your Medigap plan. Medigap is insurance to cover your Medicare deductibles & copays

- Medicare Supplements Plans – Standardized Plans to see a list of all the Medicare supplemental plans available – take a look at our Medigap supplement chart above. This chart appears in the “Choosing a Medigap,” booklet published by Medicare itself. It details the benefits covered by each different plan.

- Some of our clients have found Medicare’s handbook hard to read, so here on our site, we’ve tried to use simpler terms. Our pages about the different Medicare Supplements include examples of how the coverage would pay. This will help you understand how they work in real situations.

- Medigap Plan F and Plan G is also offered as a high-deductible plan (HDF or HDG) by some insurance companies in some states. If you choose the high-deductible option, it means you must pay for Medicare-covered costs (coinsurance, copayments, deductibles) up to the deductible amount of $2,800 in 2024 before your policy will pay anything.

- For Medigap Plans K and L, after you meet your annual out-of-pocket limit and your annual Part B deductible ($240 in 2024), the Medigap plan pays 100% of covered services for the rest of that calendar year.

- Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don’t result in an inpatient admission. You can find this chart as well as other great info in Medicare’s Choosing a Medigap booklet as well, which you can find here.

- What are the different Medicare Supplements Plans? Each Medicare Supplement plan in the chart above has a letter, A – N. Each plan letter provides a different set of benefits. However, each lettered plan must have the same standardized coverage regardless of which insurance company you choose. For example, Medicare Supplement Plan N at Blue Cross Blue Shield has the same benefits as Plan N from United Healthcare.

- The Medicare Supplement chart below shows the 10 standardized Medicare Supplement plans. These plans can be offered by insurance companies in most states.

- Wisconsin, Minnesota and Massachusetts have different options though.

- There is one supplemental insurance plan that covers ALL OF the gaps, leaving you with nothing out of pocket, Plan F. There are others where you agree to do some cost-sharing and in return you get a lower monthly premium. If you prefer something like this, in the middle, you could look at Plans G or N where you pay a few things yourself, in exchange for lower premiums.

- An insurance agent who specializes in Medicare supplemental insurance for seniors with Medicare can help you determine which one best suits you.

Important Things to Know About Medicare Supplement Coverage

- If you have a Medicare Advantage Plan, you can apply for a Medigap policy, but make sure you can leave the Medicare Advantage Plan before your Medigap policy begins.

- You pay the private insurance carrier a monthly premium for your Medigap policy in addition to the monthly Part B premium that you pay to Medicare.

- A Medigap policy covers one person. If you and your spouse both want Medigap coverage, we’ll work with you to setup two separate policies.

- Any standardized Medigap policy is guaranteed renewable even if you have health problems. This means the insurance company can’t cancel your Medigap policy as long as you pay the premium.

- If you have a Medicare Advantage Plan, you can apply for a Medigap policy, but make sure you can leave the Medicare Advantage Plan before your Medigap policy begins.

- You pay the private insurance carrier a monthly premium for your Medigap policy in addition to the monthly Part B premium that you pay to Medicare.

- A Medigap policy covers one person. If you and your spouse both want Medigap coverage, we’ll work with you to setup two separate policies.

- Any standardized Medigap policy is guaranteed renewable even if you have health problems. This means the insurance company can’t cancel your Medigap policy as long as you pay the premium.