Medicare Agent in Queens, NY

Our Experienced & Well Trained Agents Are Ready to Help Answer All Your’e Medicare Questions.

Medicare is a federal health insurance program available only to eligible citizens and legal residents of the United States and is run by the Centers for Medicare & Medicaid Services (CMS). It was started on July 30th 1965 by Lynden B Johnson.

Need Help With Medicare?

Who Qualifies For Medicare in Queens, NY

U.S. Citizen or Permanent Legal Resident

In order to qualify for full Medicare benefits, you must be a U.S. citizen or a permanent legal resident who has lived in the United States for at least five years. This means that if you are an immigrant, you must have been living in the U.S. for at least five years before you can receive Medicare coverage.

Social Security or Railroad Retirement Benefits

You also qualify for full Medicare benefits if you are receiving Social Security or railroad retirement benefits or have worked long enough to be eligible for those benefits but are not yet collecting them. This means that even if you haven’t reached retirement age yet, you may still be eligible to receive Medicare coverage if you have worked long enough and paid into the system through payroll taxes and Social Security contributions.

Government Employee or Retiree

If you or your spouse is a government employee or retiree who has not paid into Social Security but has paid Medicare payroll taxes while working, then you may also qualify for full Medicare benefits regardless of your age.

Under Age 65 with Social Security Disability Benefits

If you are under the age of 65, then you may still be eligible to receive full Medicare benefits if you have been entitled to Social Security disability benefits for at least 24 months (that need not be consecutive).

Under Age 65 with Railroad Retirement Board Pension

If you receive a disability pension from the Railroad Retirement Board and meet certain conditions, then you may also qualify for full Medicare benefits under the age of 65 regardless of whether or not you have been receiving disability benefits from the Social Security Administration for 24 months consecutively or not.

Under Age 65 with Amyotrophic Lateral Sclerosis (ALS)

Lastly, if you have Lou Gehrig’s disease, also known as amyotrophic lateral sclerosis (ALS), then this will immediately qualify you to receive full Medicare benefits regardless of your age as well as any other factors such as length of time receiving disability payments from either the Railroad Retirement Board or the Social Security Administration

Understanding Medicare Plans in Queens, NY

Medicare Advantage (Part C or MA): Explore an alternative to Original Medicare with Medicare Advantage plans from private insurers. These plans are another way to receive your original Medicare A&B benefits. All Medicare Advantage Plans must cover everything that original Medicare does as good or better. Most of the time these plans will offer Part D coverage as well. Medicare Advantage plans will also offer many extras depending on where you live. You may find plans with dental, vision, hearing, gym memberships, transportation, even money back in your social security check.

Medigap

Designed to enhance your healthcare coverage with standardized Medigap plans from private insurance companies. These plans fill the gaps in coverage left by Original Medicare. Such as Part A hospital deductible and part B coinsurance. There are 10 standardized plans offered in Queens.

Medicare Part D

19 different plans offered in Queens NY, these plans are specifically designed to help with daily prescription needs. Part D can come either stand alone or through a Medicare Advantage plan.

Medicare Advantage Agent in Queens, NY

Discover the abundance of Medicare Advantage Plans available in the heavily populated county of Queens. With a staggering total of over 90 options, including HMO, PPO, HMO-POS, and special needs plans for those with chronic illnesses or dual eligibility, the choice can seem overwhelming. However, don’t make the mistake of solely focusing on premiums and copays. Take the time to compile a list of your essential medical providers and preferred hospitals to ensure access. Once you have narrowed down your search based on providers, turn your attention to prescription coverage. Once you have found plans that meet these criteria, you can explore additional perks such as dental, vision, and hearing coverage. Make an informed decision by considering all the important factors and giving yourself peace of mind. Paul Barrett & the Modern Medicare agency offers FREE Medicare consultations, which basically are a conversation about which plans will make the most sense for you based on your needs and budget. We can help you compare plans side by side and make sure you are not missing any of the important details when choosing a plan.

Medicare Supplement Agent in Queens, NY

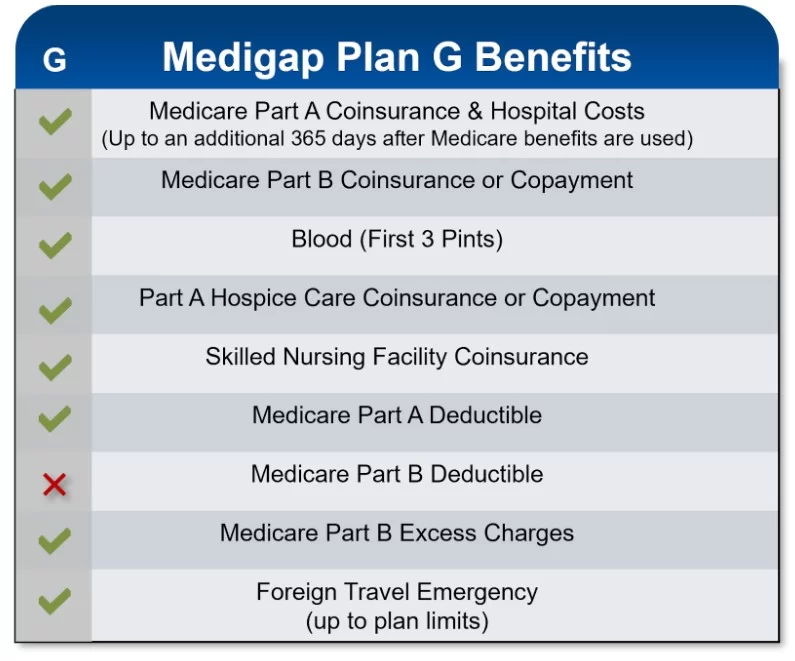

Plan G covers

The state of New York offers community rating which means everyone in Queens no matter their age or health will qualify for a Medicare supplement at the same rate. There are 10 different standardized Medigap/Medicare Supplement plans in Queens, NY. The two most popular plans in Queens, NY right now are plan G & N.

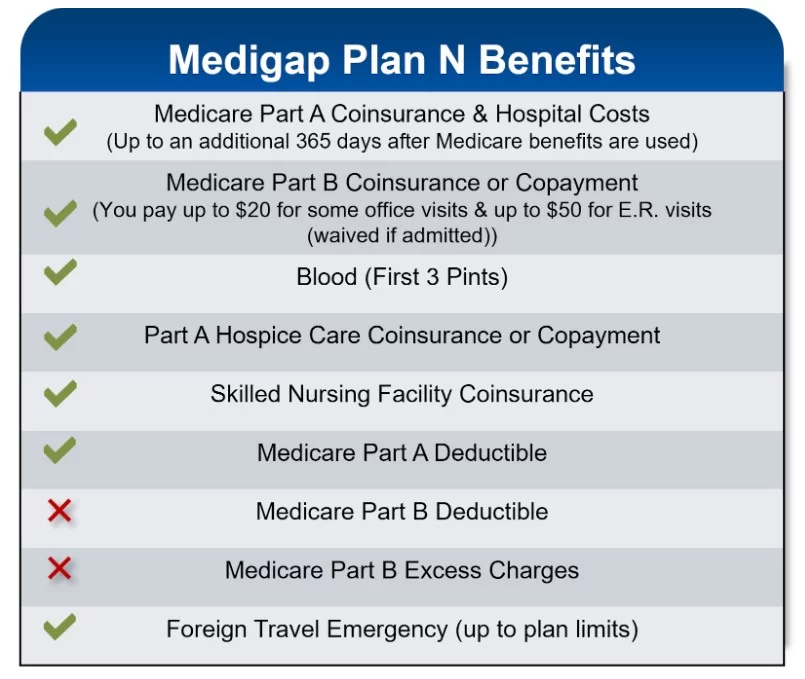

Plan N Covers

Both Medicare Supplement plans are great options for people who use their insurance often and like freedom when choosing medical providers. People who enroll in either plan will enjoy 100% of their hopital deductible covered and have very little out of pocket for Part B coverage as well. Plan G covers 100% of part B coinsurance after the consumer has met their part B deductible. Plan N covers 100% of the hospital deductible as well. Those on Plan N will have to meet their part B deductible as well and then they may be charged a maximum of $20 for a doctor’s visit. Plan N also has a $50 copay in the emergency room. For a full breakdown and comparison of the two plans you can schedule a 1 on 1 meeting or phone call with Paul Barrett or one of his team members at no cost or obligation.

Medicare Part D Agent in Queens, NY

When it comes to prescription drugs things can get tricky. There are 19 plan options all offered through private insurance carriers like Aetna, Cigna, UnitedHealthcare, Humana to name a few. Each company offers multiple plans with different drug formularies and cost sharing. A lot of people get confused when shopping for part D and it is not always so simple. Since each plan has its own preferred list of drugs it is very common for a husband & wife to have two different plans and many times from two different companies. When choosing a part D drug plan you have a few things to consider.

Premium

When choosing a Part D drug plan, the premium is always an important consideration. A lower premium may seem appealing, but it could mean higher out-of-pocket costs in the long run. Be sure to compare the premiums of different plans to find one that fits your budget and provides the coverage you need.

Deductible

Another factor to consider when selecting a Part D drug plan is whether or not it has a deductible. Some plans have a deductible, meaning you will have to pay for certain drugs until you reach your deductible amount before your plan begins covering them. Other plans do not have a deductible, so you can begin using your coverage right away without having to meet any additional requirements.

Formulary

The size of the plan’s formulary is also an important factor to consider when selecting a Part D drug plan. A formulary is essentially a list of drugs that are covered by the plan and how much they cost under the plan’s coverage terms. Make sure that all the medications you take are included in the formulary before signing up for a particular plan.

Pharmacy Network

It is also important to check if your preferred pharmacy is included in the drug plan’s network of participating pharmacies before committing to it. Many plans offer discounts on medications when they are purchased at pharmacies within their network, so make sure that your pharmacy is included in order to get the most out of your coverage.

Copays

Copays are another important factor to consider when selecting a Part D drug plan as they will determine how much money you must pay out-of-pocket for each prescription medication you purchase under your policy’s coverage terms. The copay amount varies from plan to plan, so be sure to compare different plans side-by-side and find one with copays that fit into your budget.

Plan Rules

Finally, it is important to understand what rules apply when using your Part D drug plan coverage such as quantity limits and prior authorizations for certain medications or treatments before signing up for one particular policy over another. Knowing these rules ahead of time can help ensure that you get the most out of your coverage and avoid any unexpected costs or delays in receiving needed medications or treatments down the line

Benefits of using a Medicare Agent in Queens, NY

There are many obvious reasons to work with a Medicare agent in Queens, NY.

Using an independent Medicare agent in Queens, NY, can provide several advantages, some of which include:

1. Expertise and Guidance: Independent agents specialize in Medicare and have in-depth knowledge of the various plans available in Queens, NY. They can help you navigate the complexities of Medicare, explain the differences between Original Medicare, Medicare Advantage, and Medicare Supplement plans, and guide you in selecting the most suitable plan based on your specific needs and preferences.

2. Access to Multiple Carriers: Independent agents are not tied to a single insurance company. Instead, they have relationships with multiple carriers. This means they can provide you with a broader range of options, helping you compare plans from different insurers to find one that fits your budget and covers your preferred healthcare providers.

3. Time and Effort Savings: Researching and understanding Medicare plans can be time-consuming and overwhelming. An independent agent can save you the hassle by doing the legwork for you. They can quickly gather information, explain your options, and streamline the enrollment process.

4. Personalized Recommendations: Independent agents take the time to understand your unique healthcare needs, budget, and preferences. They can then tailor their recommendations to suit your individual circumstances, ensuring you get the most appropriate coverage.

5. Annual Plan Reviews: Medicare plans can change from year to year, and what was the best option one year may not be the next. An independent agent can review your plan annually to make sure it still meets your needs and recommend adjustments if necessary.

6. No Additional Cost: Independent Medicare agents are typically compensated by the insurance companies they work with, so their services are often provided at no additional cost to you. You can benefit from their expertise without paying any fees.

7. Local Knowledge: Independent agents who operate in Queens, NY, are likely to have a good understanding of the local healthcare landscape. They may be familiar with the network of doctors, hospitals, and healthcare facilities in the area, which can be beneficial when choosing a plan that includes your preferred providers.

8. Assistance with Claims and Issues: If you encounter any issues or have questions about your Medicare coverage, an independent agent can be a valuable resource. They can assist you with claims, help you understand coverage details, and advocate on your behalf with the insurance company if needed.

Overall, working with an independent Medicare agent in Queens, NY, can offer personalized support, access to multiple plan options, and peace of mind, ensuring you make informed decisions about your Medicare coverage.

Paul Barrett & his team of agents at The Modern Medicare Agency are all experts in local Medicare plans & information and offer complimentary Medicare consultations all year round.