You cannot ignore the importance of medical insurance, particularly the Medicare Advantage Plan Part C options that match your unique needs. However, the research required to maneuver the process and find the most suitable carrier does not have to be daunting when you have all the correct information.

What are Medicare Advantage Plans?

Medicare Advantage Plans are simple health insurance plans that provide several advantages over and above original Medicare. Private insurance carriers like Aetna, Cigna, Capital Blue Cross, etc., have contracts with the Center for Medicare & Medicaid Services (CMS) to cover everything under original Medicare. These are often also known as Medicare Advantage Plans Part C.

Finding a Medicare Advantage Plan In Your Area:

At the Modern Medicare Agency, we are a team of professionals licensed in New York and 17 other states, we don’t favor any policy above another but help curate one based on one-on-one advice and options from several Medicare-approved carriers based on your lifestyle and healthcare needs.

Medicare – The Federal Health Insurance

Most people turning 65 that enroll for social security without Medigap can get Original Medicare. It is also available to people with disabilities, and those with end-stage renal disease can sign up.

Unfortunately, Medicare often leaves you with a lot of out-of-pocket expenses. Therefore, Part A will cover your hospital and inpatient stay after a $1556 deductible that gets paid per event. Part B has a smaller deductible of $233 and covers up to 80% of your doctor and outpatient bills. It’s important to note, however, that these costs will be changing in January, 2023.

Original Medicare has no maximum out-of-pocket for medical expenses, which means no limit to the amount you pay. Plus, it won’t cover prescription drugs.

Additionally, original Medicare does not provide audio, dental, or visual cover unless you have a severe infection or cancer.

Supplementing Medicare with Medicare Advantage Plans

In our Medicare Explained page you can see a video our CEO produced to help clients simplify the various components. Now that you understand what Medicare Advantage Plans are and the importance of “Part C”, It is important to know that when you join a Medicare Advantage Plan, you don’t lose the right to your original Medicare; you take advantage of the benefits offered by a private company for your chosen period.

You pay a fixed amount monthly, according to the plan you have chosen, to the company with the Medicare Advantage Plan you chose.

One of the significant advantages of Medicare Advantage Plans is that, at the very least, they offer you precisely the same as Medicare since they follow its rules, but they can also offer more.

Secondly, all Medicare Advantage Plans have a maximum out-of-pocket that acts like a financial safety net. Most insurers also include a prescription drug plan, which is essential if you don’t have any other drug coverage.

Finally, Medicare Advantage Plans also allow you to add audio, dental, and visual plans – in some areas, they have a small fee, while they are free in others. The benefit of having these in your coverage means that you don’t need to put yourself at the expense of getting an additional policy that will only complicate your life.

Types of Medicare Advantage Plans

There are several Medicare Advantage Plans:

Medicare HMOs

Medicare HMOs have the lowest premiums; sometimes, people pay nothing. However, with HMOs, you can only see a network of specific doctors and hospitals specified in the plan, and you select your primary care physician(PCP). Your PCP can recommend specialist treatment when needed. These plans include Medicare Part D drug plans, but you must ensure they specify your medications.

Preferred Provider Organization Plans

Preferred Provider Organization (PPO) is the second type of plan. Here the Medicare insurance company works with a preferred list of providers they like for the patient to see as the patient will most likely pay less when using these providers. However, patients can see out-of-network providers as well, albeit at a higher cost.

There is a typical $7,550 maximum out-of-pocket cap that can protect you in years with higher-than-usual medical expenses, however, this varies quite a bit from area to area. You should ensure that your plan has an integrated Part D plan because you can’t get a separate one, and the premium for an original Medicare Part B is $170.10. Medicare Advantage premiums start at nothing and vary greatly depending on the insurance carrier and where you live. Some plans include benefits like discounted gym plans and vision checks.

Private Fee-for-Service Plans

Private Fee-for-Service Plans (PFFS) are not limited to network providers and are ideal for you if you travel frequently. You pay the premiums for the plan. You have copays and coinsurance according to the plan stipulations, and some plans have a built-in drug plan, or you can have a separate Part D plan.

Special Needs Plans

Finally, Special Needs Plans (SNPs) have limited membership for beneficiaries with specific illnesses. Besides being tailored to the individual, they also include a Part D drug plan. These include Dual Eligible Special Needs Plans (DSNP) for dual eligibility for Medicare & Medicaid; Chronic Condition Special Needs Plans (CSNP) for people with chronic health needs; Institutionalized Special Needs Plans (ISNP) for patients who are in a long-term care facility, or certain insurance carriers which provide plans suited to these specific illnesses.

Finding Medicare Advantage Plans Near Me With The Modern Medicare Agency

When searching for “Medicare Advantage Plans near me,” your choices will depend on your area. Comparing your options in a Medicare and You guide does not often provide enough detailed information about each plan.

All you can see is the lowest co-pays and how much you pay to see a specialist. But, unfortunately, these details are insufficient to help you understand which one suits you best, especially if you don’t want to change your doctors.

When deciding, you need to understand everything covered by the Medicare Advantage Plan, including their guaranteed list of drugs. This information ensures you have the precise coverage required, whether you need medication for diabetes, cholesterol, blood pressure, or any other chronic conditions.

Since different plans cover different needs, choosing a good plan to meet your needs can sometimes prove tricky. In addition, if you are a couple, one person’s needs sometimes mean that some plans offer more savings in one area and less in another; for example, you may save more money on prescriptions than seeing specialists.

At The Modern Medicare Agency, we look for good star ratings, a good provider network, and affordable copays. However, it’s also crucial to know if it includes your doctors, hospitals, and the prescription medications you use. Furthermore, one final but important consideration is your lifestyle.

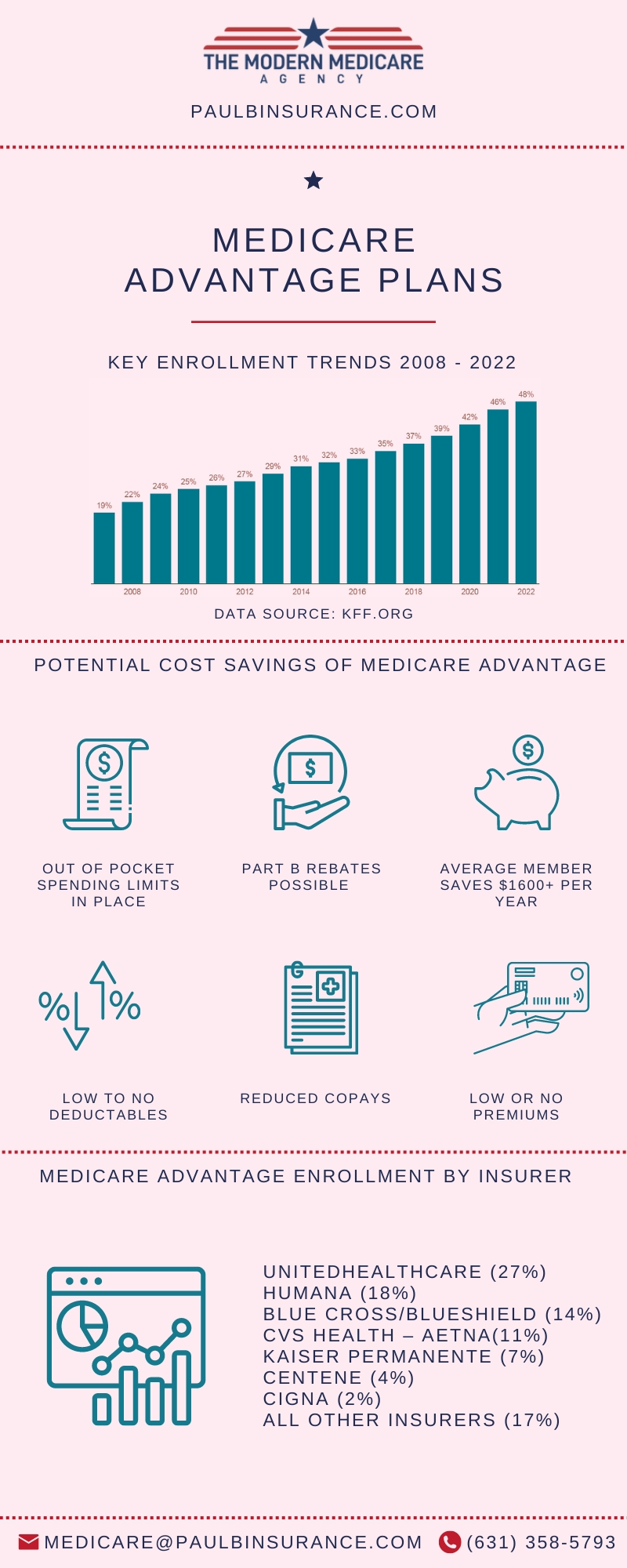

Medicare Advantage Infographic: The increase in annual popularity

[Download the Medicare Advantage Infographic PDF Here]

Next Steps – How To Obtain Medicare Advantage Plans In Your Area:

Contact us today and speak with a personalized broker from our team of specialists. They can help facilitate the process as you learn more about the best Medicare Advantage Plans Part C and choose the several Medicare-approved programs for you. As an independent agency, we aim to take you through finding “medicare advantage plans near me” from start to finish, ensuring you get the best program from a wide range of providers at minimal fees.