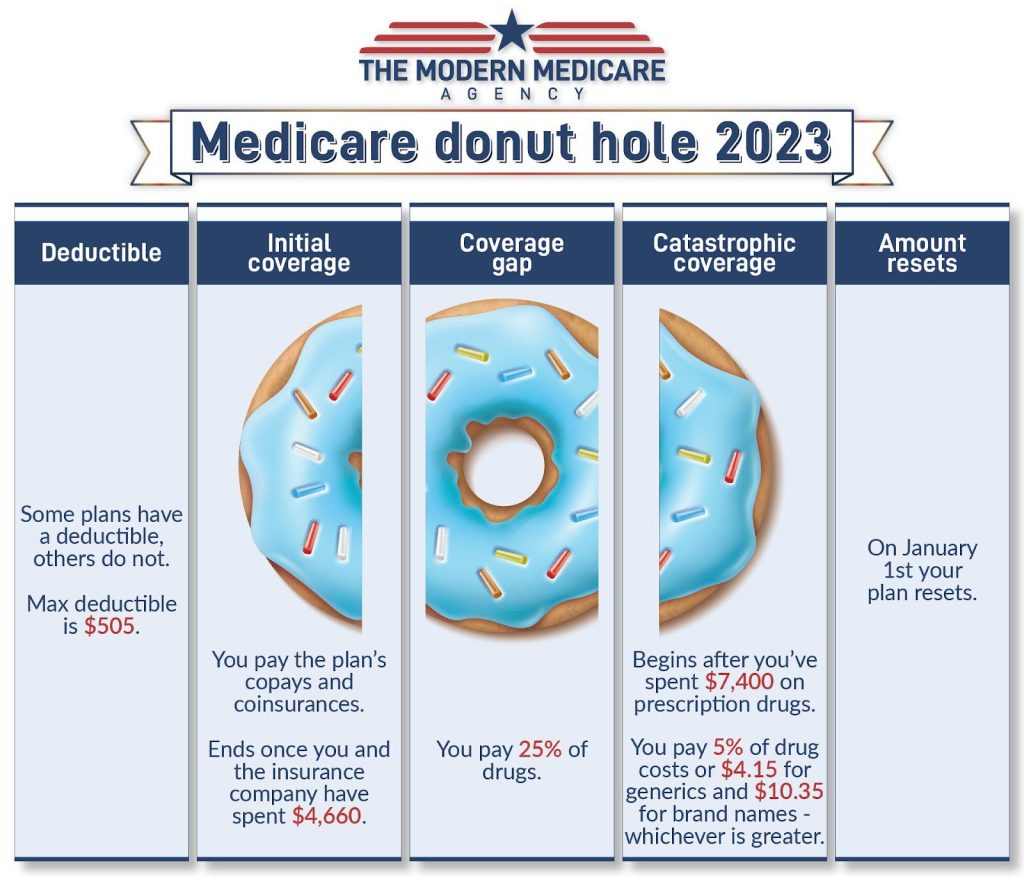

Medicare Part D prescription drug plans usually have a coverage gap called the “donut hole.” The gap occurs when you pass the second tier of Part D coverage, found in many plans, and have reached the limit you and your insurer have paid. For 2023, the threshold on covered drugs will increase from $4,430 to $4,660. During this stage, you pay a percentage of the cost of your prescription medications if it exceeds the covered amount.

Explaining the Donut Hole

At The Modern Medicare Agency, we understand that the implications of not having the right plan can cause distress. So, besides helping senior consumers make the right decisions by researching and picking the suitable add-on options to their Medicare insurance plan, we also want them to understand all the confusing terminology.

Therefore, let’s help you understand the donut hole and how to get out of it.

What is a Medicare Donut Hole?

Medicare leaves people with many out-of-pocket expenses because it does not cover most outpatient prescription drugs. However, private insurance carriers offer medication coverage to consumers with Medicare Part D plans, also available with Medicare Advantage Plans as an opt-in program.

These plans follow Medicare\’s standard model and don’t differ much. However, it’s essential to know that they have four stages or phases, and the donut hole occurs in stage 3.

What stages lead to the Part D Donut Hole?

To manage the annual costs of your Part D, you need to understand its coverage stages.

Stage 1— The Deductible Stage

In most Part D plans, you pay an annual deductible of 100% of the cost of prescription drugs for a certain limit before they start to pay. The deductibles vary between Part D plans, with most for tier 1 and tier 2 drugs having no deductible on their coverage. The deductibles for 2023 can’t exceed $505. Your initial coverage kicks in once you exceed the deductible amount.

We know of only one plan that charges consumers for tier 2 drugs. People who don’t take any medications usually enroll in this plan.

Bear in mind that if you take tier 1 or tier 2 preferred generics or generic drugs, these hardly ever apply to the deductible. Therefore, you may either pay nothing to obtain these or have a very low copay for them. Many carriers prefer you to use mail orders from them and will often waive copays for drugs on these tiers.

Stage 2—Initial Coverage Stage

During the initial coverage stage, your copayments and coinsurance activate. Once reached, you pay for your share of prescription costs according to the benefit structure, and your Part D plan pays the rest for the drugs covered.

When you reach the limit of $4,660 for 2023, which includes everything paid by you and your insurance carrier, you enter this coverage gap (also known as the donut hole) of your Part D.

Stage 3—Medicare Part D Coverage Gap (Donut Hole)

Once you have exceeded the limit of the initial coverage stage, with most Medicare drug plans, you reach the temporary limit known as the coverage gap or “donut hole.” Luckily, not everyone enters the Coverage Gap, which won’t apply to members who qualify for Medicare Extra Help.

At this stage, you’ll pay up to 25% of the cost for the brand-name and generic prescription drugs under your Part D plan, but their total cost moves you closer to the Catastrophic Coverage stage.

You move out of the Coverage Gap after you spend $7,4000 for 2023.

Stage 4—Catastrophic Coverage Stage

During Part D plan coverage, you pay a small coinsurance or copayment for the drugs covered by your plan for the rest of the year. As soon as the plan year ends, you start from stage 1 again.

What happens after I leave the Coverage Gap or Donut Hole?

After leaving the Donut Hole phase of your prescription drug plan, as a Medicare Part D beneficiary, you enter into the last phase of the program – the Catastrophic Coverage. From this point on, you pay $4.15 per month for generics / $10.35 per month for name-brand medications or 5% of the medication\’s retail cost, whichever cost is higher.

Is the “Donut Hole” the same for everyone?

No, the “donut hole” is not the same for everyone since some people qualify for Extra Help from Medicare to help pay Part D costs.

Additionally, most people never enter the coverage gap – currently at $4,430 (with an increase of $4,660 for 2023).

How does the “donut hole” coverage gap work?

The built-in gap in coverage of Part D plans provisionally restricts the total your insurance will pay for prescription drugs after reaching the initial plan coverage limits and before the catastrophic coverage stage.

At the beginning of Medicare Part D, plans members paid the full cost of covered drugs at this phase until their total costs qualified them to move into the catastrophic stage. That gave rise to the commonly used term “Medicare donut hole.”

Will the Medicare “donut hole” go away?

The donut hole continues to shrink thanks to the enactment of the Affordable Care Act in 2010. The act included provisions for the gradual shrinkage of the coverage gap.

Before 2019, members paid up to 100% of their costs in the gap. Today the amount is limited to 25% for their brand-name and generic drugs. So even though the coverage gap has closed, it remains relevant regarding prescription drug coverage.

What are the costs within the coverage gap?

Brand Name Prescription Drugs

When you reach the donut hole, you pay no more than 25% for your plan’s covered brand-name prescription drugs. Some plans have lower costs in the coverage gap. The discount comes off the price set with your plan for every specific drug with pharmacies.

However, despite the discounted price you pay, almost the drug’s full price is recorded as your out-of-pocket spending, helping you get out of the coverage gap. Therefore, the manufacturer pays 70% of the discount price. The plan pays 5%, and you pay 25%.

You also pay 25% of the dispensing fee, while your plan pays 75%. Therefore, the costs not included in your out-of-pocket expenses are 5% of the drug plan’s cost and 75% of the dispensing fee.

If your Medicare Part D plan already includes coverage in the gap, you may also get a discount after its coverage on the drug’s price, applying it to the remaining amount owed by you.

Generic Drugs

Medicare pays 75% of the price of generic drugs during the coverage gap. You pay for the rest. The coverage for generic drugs works in another way from the discount for brand-name drugs, since only the amount you pay counts toward getting you out of the “donut hole.”

If your Medicare drug plan already includes coverage in the gap, you may get a deduction after its coverage gets applied to the drug’s price.

Which items count towards the coverage gap or “donut hole”?

- Your annual deductible, your coinsurance, and your copayments

- The reduction you get on brand-name drugs in the coverage gap

- Everything you pay for in the coverage gap

Which items don’t count toward the coverage gap?

- Your drug plan premium

- Pharmacy dispensing fee

- Cost of drugs that aren’t covered

Can you avoid the donut hole?

At the Modern Medicare Center, we aim to help you compare prescription drug plans so that you can get their full benefits. We look for the best coverage based on your medications, and you should do this annually to ensure the best coverage. You can also avoid the donut hole by preferring generics over brand-name prescription drugs, and you may qualify for a low-income subsidy known as Extra Help.

Final Take

Get in touch with us at The Modern Medicare Agency today for help when looking for Medicare drug coverage options to avoid reaching the donut hole or coverage gap.